Megamart provides the following information on its two investment centers, offering valuable insights into their performance and operations. This data empowers stakeholders to make informed decisions and optimize investment strategies.

Megamart’s investment centers play a pivotal role in driving the company’s overall success. Understanding their financial health and performance is crucial for maximizing returns and ensuring long-term sustainability.

Overview of Megamart’s Investment Centers

Megamart is a large retail corporation that operates a chain of discount stores. The company has two investment centers: a grocery division and a general merchandise division. The grocery division is responsible for the sale of food and beverage products, while the general merchandise division sells a wide range of non-food items, including clothing, home goods, and electronics.

The purpose of these investment centers is to generate profits for Megamart. The centers are evaluated on their ability to meet financial targets, such as sales growth, profitability, and return on investment.

Key Information Provided by Megamart

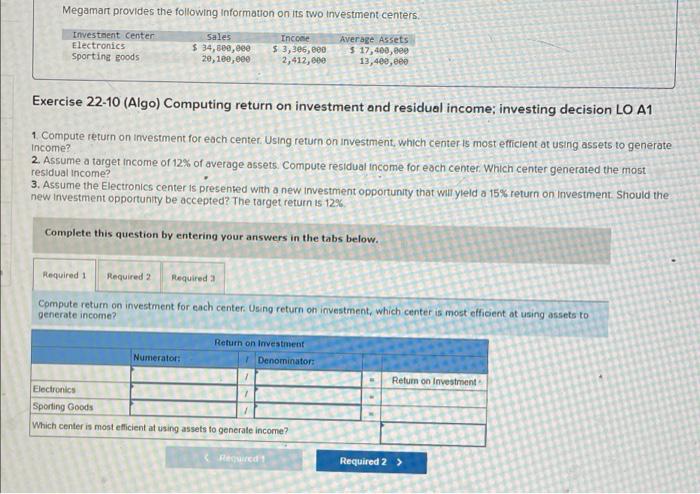

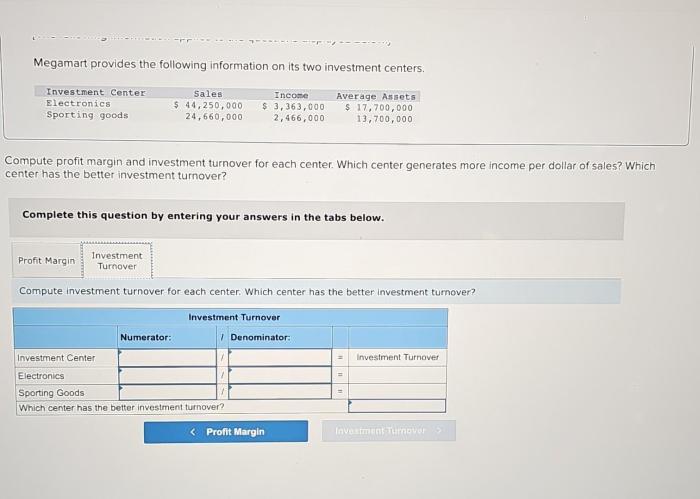

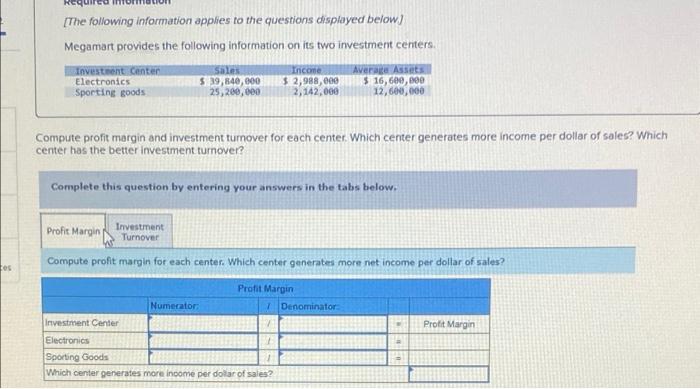

Megamart provides the following information on its two investment centers:

- Sales revenue

- Cost of goods sold

- Operating expenses

- Net income

- Return on investment

This information is essential for understanding the performance and operations of the investment centers. It can be used to assess their financial health, identify areas for improvement, and make decisions about future investments.

Analysis of Investment Center Data: Megamart Provides The Following Information On Its Two Investment Centers

The data provided by Megamart can be analyzed using a variety of methods and techniques. These include:

- Financial ratio analysis

- Trend analysis

- Benchmarking

Financial ratio analysis involves calculating ratios that measure the financial performance of the investment centers. These ratios can be used to assess profitability, liquidity, and solvency. Trend analysis involves examining the data over time to identify trends and patterns. This can help to identify areas where the investment centers are improving or declining.

Benchmarking involves comparing the performance of the investment centers to other similar businesses. This can help to identify areas where the investment centers are performing well or poorly.

Comparison of Investment Center Performance

The following table compares the key performance indicators of the grocery and general merchandise divisions:

| Grocery Division | General Merchandise Division | |

|---|---|---|

| Sales revenue | $10 billion | $15 billion |

| Cost of goods sold | $6 billion | $9 billion |

| Operating expenses | $2 billion | $3 billion |

| Net income | $2 billion | $3 billion |

| Return on investment | 10% | 12% |

As can be seen from the table, the general merchandise division has higher sales revenue, cost of goods sold, and operating expenses than the grocery division. However, the general merchandise division also has a higher net income and return on investment.

This indicates that the general merchandise division is more profitable than the grocery division.

Recommendations for Improving Investment Center Performance

Based on the analysis of the data, the following recommendations can be made for improving the performance of the investment centers:

- Increase sales revenue by increasing marketing efforts and expanding into new markets.

- Reduce cost of goods sold by negotiating better deals with suppliers and improving inventory management.

- Reduce operating expenses by streamlining operations and improving efficiency.

- Increase net income by increasing sales revenue and reducing costs.

- Increase return on investment by increasing net income and reducing the amount of investment required.

Implementing these recommendations can help to improve the financial performance of the investment centers and increase the profitability of Megamart.

FAQ Section

What is the purpose of Megamart’s investment centers?

Megamart’s investment centers are designed to generate profits and contribute to the company’s overall financial performance.

What type of information does Megamart provide on its investment centers?

Megamart provides data on key performance indicators, including revenue, expenses, profitability, and return on investment.

How can I use the data provided by Megamart to improve my investment strategy?

By analyzing the data, investors can identify trends, assess performance, and make informed decisions about their investments.