Embark on a captivating journey with “Feed the Piggy Bank Crossword,” a comprehensive guide that unravels the secrets of financial literacy through the beloved tradition of piggy banks. This insightful narrative delves into the significance, methods, and benefits of saving money, empowering you with the knowledge to achieve your financial goals.

From setting financial targets to exploring creative ways to make saving fun, “Feed the Piggy Bank Crossword” provides a wealth of practical advice and engaging examples. Discover how individuals and groups have successfully utilized piggy banks to transform their financial habits and achieve remarkable savings milestones.

Definition of “Feed the Piggy Bank”

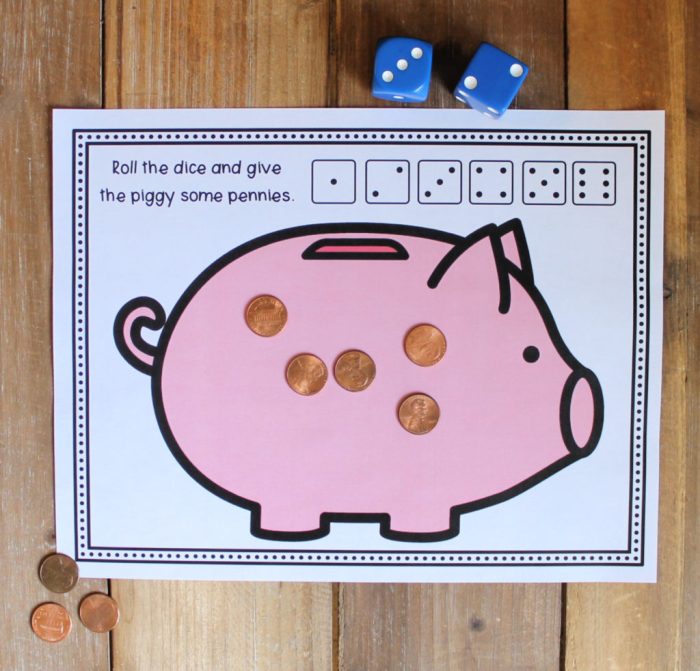

The phrase “feed the piggy bank” refers to the act of saving money by putting it in a piggy bank, which is a container specifically designed for saving money.

Piggy banks are typically made of ceramic, plastic, or metal and often have a slot or opening at the top for inserting coins or bills. They serve as a visual reminder to save money and can be a fun and engaging way to encourage saving habits, especially among children.

Methods of Feeding a Piggy Bank

Contributing to a piggy bank involves implementing various saving strategies. Establishing clear financial goals and devising a comprehensive savings plan are crucial for effective saving.

Setting Financial Goals

Identifying specific financial objectives, such as saving for a down payment on a house or a future vacation, provides motivation and direction for your saving efforts. Goals should be realistic, achievable, and aligned with your overall financial situation.

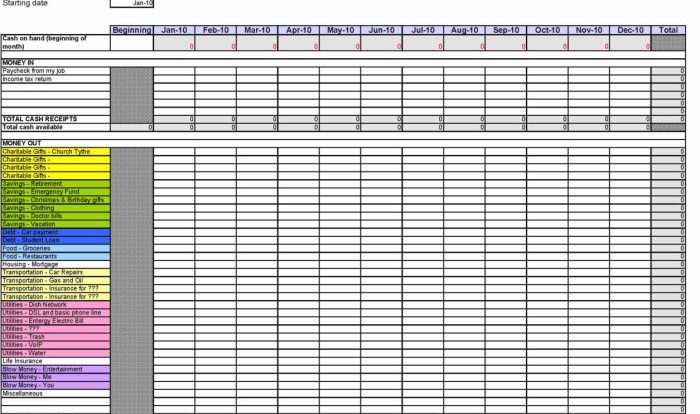

Creating a Savings Plan

A structured savings plan Artikels the specific actions you will take to reach your financial goals. This includes determining how much you will save each month, how often you will contribute, and where you will keep your savings.

Regular Deposits

Consistently adding money to your piggy bank, regardless of the amount, is essential for building savings over time. Automatic transfers from your checking account to a savings account can help ensure regular contributions.

Round-Up Savings

Rounding up purchases to the nearest dollar and transferring the difference to your piggy bank is a simple and effective way to save small amounts that accumulate over time.

Windfalls

Unexpected income, such as bonuses, tax refunds, or gifts, can provide opportunities to make significant contributions to your piggy bank. Allocate a portion of these windfalls to your savings to accelerate your progress.

Reduce Expenses

Identifying areas where you can cut back on unnecessary expenses can free up additional funds for saving. Consider negotiating lower bills, reducing subscriptions, or finding more cost-effective alternatives for goods and services.

Benefits of Feeding a Piggy Bank

Saving money in a piggy bank offers several advantages that contribute to financial well-being. It promotes financial responsibility by encouraging individuals to set aside money regularly, even in small amounts. This practice instills a sense of discipline and control over personal finances, laying the foundation for responsible financial habits in the long run.

Sense of Accomplishment

As the piggy bank gradually fills up, it provides a tangible representation of progress towards financial goals. This visual reminder serves as a constant motivator, fostering a sense of accomplishment and satisfaction. The act of physically adding coins or bills to the piggy bank creates a sense of ownership and encourages continued saving.

Examples of Feeding a Piggy Bank: Feed The Piggy Bank Crossword

Individuals and groups have successfully harnessed the power of piggy banks to achieve their savings goals. Let’s delve into real-life examples showcasing diverse strategies employed to feed the piggy bank.

The “Feed the Piggy Bank” crossword puzzle may have left you yearning for more mental stimulation. For those seeking a challenge, I highly recommend the AP Psych Unit 4 Practice Test . It’s an excellent way to test your knowledge and prepare for the actual exam.

After conquering this practice test, you’ll feel even more confident in your ability to “feed the piggy bank” of your knowledge on the real deal.

Individual Strategies

- The Round-Up Method:Rounding up everyday purchases to the nearest dollar and depositing the difference in the piggy bank.

- The Spare Change Challenge:Collecting spare change throughout the day and depositing it regularly in the piggy bank.

- The 52-Week Savings Plan:Saving a specific amount each week, increasing gradually over the year, and depositing it in the piggy bank.

Group Initiatives

- Community Savings Clubs:Groups of individuals pooling their savings in a shared piggy bank and setting collective goals.

- School Savings Programs:Educational institutions encouraging students to save through piggy banks and teaching financial literacy.

- Workplace Savings Initiatives:Employers offering incentives or matching contributions for employees who participate in piggy bank savings programs.

Creative Ways to Feed a Piggy Bank

Saving money doesn’t have to be a chore. With a little creativity, you can make it fun and engaging. Here are some unique and innovative ideas to feed your piggy bank:

Gamification

Turn saving into a game by setting challenges and rewards for yourself. For example, you could set a goal to save a certain amount of money each week and reward yourself with a small treat if you reach it.

Challenges

Make saving a competition by challenging yourself or others to save as much money as possible over a certain period of time. You could even create a leaderboard to track your progress and add an element of friendly competition.

Rewards

Motivate yourself to save by setting up a reward system. This could be anything from a small gift to a special experience. The reward should be something that you value and will motivate you to reach your savings goals.

Challenges of Feeding a Piggy Bank

The journey of saving money in a piggy bank can be rewarding, but it also comes with potential challenges. Understanding these obstacles and devising strategies to overcome them is crucial for maintaining motivation and achieving financial goals.

One common challenge is lack of self-discipline. The allure of spending money can be tempting, making it difficult to resist dipping into savings. To address this, it’s helpful to establish clear financial goals and remind yourself of the long-term benefits of saving.

Temptations and Distractions

Saving money requires resisting temptations and distractions. Identifying potential triggers, such as online shopping or social media, can help you develop strategies to avoid them. For example, consider setting aside specific times for browsing and limit exposure to promotional emails or advertisements.

Alternative Savings Methods

Piggy banks are a great way to save money, but they are not the only option. There are many other savings methods that may complement or replace piggy banks. Each method has its own advantages and disadvantages, so it is important to compare and contrast them before deciding which one is right for you.

Traditional Savings Accounts

Traditional savings accounts are offered by banks and credit unions. They are a safe and secure way to save money, and they typically offer a modest interest rate. The main disadvantage of traditional savings accounts is that they are not very flexible.

You cannot access your money without going to the bank or using an ATM, and there may be limits on how often you can withdraw money.

Money Market Accounts

Money market accounts are similar to traditional savings accounts, but they offer a higher interest rate. However, money market accounts also have more restrictions. You may only be able to make a certain number of withdrawals per month, and you may have to maintain a minimum balance.

Certificates of Deposit (CDs)

Certificates of deposit (CDs) are a type of savings account that offers a fixed interest rate for a specified period of time. CDs are a good option for people who want to save money for a specific goal, such as a down payment on a house or a new car.

The main disadvantage of CDs is that you cannot access your money until the CD matures.

Investment Accounts, Feed the piggy bank crossword

Investment accounts are a way to save money and grow your wealth over time. Investment accounts can be used to invest in stocks, bonds, and mutual funds. Investment accounts offer the potential for higher returns than traditional savings accounts, but they also come with more risk.

Peer-to-Peer Lending

Peer-to-peer lending is a way to lend money to other people directly. Peer-to-peer lending can be a good way to earn a higher interest rate than you would get from a traditional savings account. However, peer-to-peer lending also comes with more risk.

Piggy Bank as a Symbol

Piggy banks have become a ubiquitous symbol of thrift and financial responsibility, but their significance extends beyond mere monetary storage. Across cultures and contexts, they embody profound concepts related to wealth, security, and prosperity.

Cultural Symbolism

- China:In Chinese culture, pigs are associated with good fortune and wealth. Piggy banks shaped like pigs are believed to attract prosperity and abundance.

- Japan:In Japan, piggy banks are known as “buta-bang” and are often decorated with images of pigs. They symbolize the importance of saving for the future and ensuring financial security.

- United States:In the United States, piggy banks are typically shaped like pigs and are used to encourage children to save money. They represent the concept of delayed gratification and the value of financial planning.

Quick FAQs

What is the purpose of a piggy bank?

A piggy bank is a traditional savings tool designed to encourage saving money and promote financial responsibility.

How can I make saving money fun?

“Feed the Piggy Bank Crossword” offers creative ideas for gamifying the saving process, such as setting challenges or incorporating rewards.

What are the benefits of saving money in a piggy bank?

Saving money in a piggy bank can help you set financial goals, track your progress, and instill a sense of accomplishment.